This past Friday, two pieces of news in the Binghamton newspaper caught my attention, both on the front page. The first read: “U.S. Family Incomes are Falling, gap between wealthy, other groups widens from 2001-2004, Fed reports” and the other “Free clinics growing as need increases, rising insurance costs force more to seek alternative services.”

According to the first article, by Martin Crutsinger of the AP, “average family incomes, after adjusting for inflation, fell to $70,700 in 2004, a drop of 2.3 percent when compared with 2001… the gap between the very wealthy and other income groups widened during the period. The top 10- percent of households saw their net worth rise by 6.1 percent to an average of $3.11 million while the bottom 25 percent suffered a decline from a net worth in which their assets equaled their liabilities in 2001 to owing $1,400 more than their total assets in 2004.” In fact, the gap between the richest and poorest has been increasing for more than two decades.[1]

The article other detailed the rising importance of free clinics, focusing upon on in Broome County. It read: “estimates show about 15.5 percent of New York’s population are without insurance, which translates to as many as 38,000 people in [the Binghamton Metropolitan] area… While most of the patients work, they may have part-time jobs that don’t offer health insurance or the premiums they’d have to pay are unaffordable; 95 percent of patients report their annual income as less than $20,000.” This is troubling, especially since there was an article in the Wednesday paper entitled “Health care costs by 2015 20% of income.”

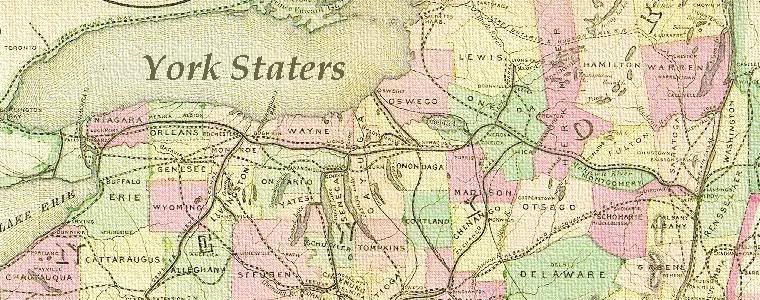

Of course this discussion of large categories like “bottom 25%” and “top 10 percent” hide the incredible disparity at the top. According to Forbes list of the richest 400 Americans, New York has 48 members of the “Rich List” with a combined net worth of $89,100 million (that’s $89,100,000,000)[2]. To put this in perspective, New York has a population 19,011,378 people with a combined wealth of $900,000,000,000 and an average income of $35,884 [3]. According to my calculations, this means that .0002% of New Yorkers own 10% of the state’s wealth (how much they control through heading boards of companies and non-profits and through stock is almost impossible to gauge) [4]. A glance at the list shows that all 48 live Downstate, the vast majority in the City itself.

So, what am I getting at here? Am I about to launch into a Kerry-like tirade against the “top 1% of Americans” (a group I believe both Kerry and Bush may belong to)? Isn’t this the moment when Liberals proclaim a need for graded income tax, national health care, more money for Head Start, etc?

However, I am not a classic liberal and I am not going to call for an increase of taxes, though I will condemn these individuals, as they deserve. To think that 38,000 people in Broome County are forced to wait long into the night at free clinics while working at two or more jobs just to get to health care while Mr. Newhouse down in Bedford, NY has $7.7 billion (that’s $202,631 per insurance-less person in Broome County) is disgusting. But this is not a problem that federal taxes will solve.

Why? Because the problem is not where wealth is concentrated, but the concentration of wealth itself. Whether it is in the hands of 48 people living in penthouses or in a handful who have been “elected” in Albany or Washington often makes little difference. We should be learning that concentrating wealth in Washington leads to horrible corruption (think Jack Abramhoff, the scandals in Iraq, the Clinton-ear debacles and the day-to-day graft known as the pork barrel). Republicans want to concentrate wealth amongst those who are already wealthy and into the military (and military contractors), Democrats rarely want to challenge those who are already wealth, instead leaning on the middle class and poor to draw out funds for their tremendous government programs. The tragedy of Katrina can show what happens when people rely too much on centralized, federal bureaucracies for their survival.

With either party, productivity (how much labor can be squeezed out of each worker in an hour) has only risen since the 1970s, corporate profits have spiraled upwards from around $20 billion in 1970 to around $640 billion in 2003, while real wages have declined over that time. Yet, our individual tax burden, as a percentage of income, has increased over the decades. These trends have continued with both Democrats and Republicans.

So what can be done? The centralization of wealth in individuals and the government continues in part because we are ambivalent to it. We spend money at Wal-Mart, which continually siphons off funds to Bentonville; we are too often quiet to government’s continual thievery to support wars and corruption. Wealth is built within communities through the labor of individuals, the siphoning occurs afterwards. If we were instead to build mechanisms of local control and local interdependence (like the Ithaca Hour, the Dudley Street Neighborhood Initiative or the Battenkill Cooperative Kitchen, to quote a few that I have discussed), wealth would circulate locally and remain to deal with local problems. Of course, this is easier to say than do and the immense power of pro-corporate, pro-centralization propaganda cannot be denied, and the same is true for the immense amount of work that must be done. However, I believe strongly in our traditions of innovation and social justice here in Upstate New York and think we are up to the task.

-Posted by Jesse

[1] http://www.publicagenda.org/issues/factfiles_detail.cfm?issue_type=welfare&list=7

[2] The wealthiest, a Mr. Samuel Irving Newhouse Jr., has accumulated $7,700,000,000.

[3] Stats on us normal folk are from here

[4] Meanwhile, 14.4% of New Yorkers live below the poverty line (http://www.publicagenda.org/issues/factfiles_detail.cfm?issue_type=welfare&list=6)

2.27.2006

Subscribe to:

Post Comments (Atom)

1 comment:

A few technical comments on the article.

NY Wealth

combined net worth of $89,100 million (that’s $89,100,000,000)[2]. To put this in perspective, New York has a population 19,011,378 people with a combined wealth of $900,000,000,000 and an average income of $35,884 [3]. According to my calculations, this means that .0002% of New Yorkers own 10% of the state’s wealth

That figure for New York state is GDP[1], which is new value created each and every year, not the total accumulated wealth which is the figure for the individuals(apples and oranges). Assuming these wealthy individuals are taking in 10% more each year( a fairly generous, yet realistic APR) that percentage drops from 10% to 1%. still a large amount for a hand full of people of course.

As stated, that none of these people live in upstate, highlights that these figures shouldn't be taken right at face value, NYC will draw in people who make that kind of money, no matter where in the country/world they originally accumulated that money. Basically if someone with a billion dollars were to move into broome county, it would skew all kinds of data, yet the county isnt any worse off(or better off) then it was prior to his/her arrival.

My second comment is on the inaccurate data from Forbes to start with. Most (if not all) of those people listed has the majority of their "wealth" in the form of company stock. Take #1 bill gates for example. His net worth is determined primarily by taking the number of shares of Microsoft he has and multiplying it by the last traded price on the day the article was written. But that last trade was a few thousand shares. If Billy actually wanted money, and were to dump his shares on the market, the price he would receive would be far less then its current price. MAYBE he would get half the number Forbes is claiming he has. And true he could sell little by little over a long period and get say 75%. But that isn't his net worth TODAY. This is similar to someone telling you that there is 500,000 worth of buried gold under your house, but to get at it, you will have to destroy your home worth 150,000. It isn’t logical to say that your net worth is 650,000 which is the type of math that Forbes does in order to get the figures as high as they can.

Healthcare

“Health care costs by 2015 20% of income.”

Again this 20% is not 20% of a persons income but rather 20% of the nations GDP. Since we already know how uneven that distribution is. Those people with standard 40hr jobs will pay far more than 20% of their income to health care in the coming years.

http://www.empire.state.ny.us/nysdc/Othereconomic/gspranks.pdf

http://www.askquestions.org/articles/taxes/#05

http://www.faireconomy.org/Taxes/HTMLReports/Shifty_Tax_Cuts.html

Post a Comment